In recent years, mobile money services have revolutionized the way we conduct financial transactions in Uganda. Among the various service providers, Airtel has established itself as a leading player, offering a variety of services including mobile money transfers, bill payments, and cash withdrawals. However, with these services come certain fees that users must be aware of, particularly the Airtel withdraw charges in Uganda. Understanding these charges is essential for users to make informed decisions when using mobile money services.

The Airtel mobile money platform not only provides convenience but also comes with specific costs associated with withdrawals. These charges can vary based on factors such as the amount being withdrawn and the type of transaction. By familiarizing themselves with these fees, users can effectively manage their finances and avoid unexpected costs. This article will delve into the details of Airtel withdraw charges in Uganda, helping users navigate their mobile money experience with ease.

As the demand for mobile money services continues to grow, understanding the financial implications of using Airtel's services becomes increasingly important. This guide will outline the various withdrawal charges, the process of withdrawing funds, and tips on how to minimize costs. With a clear understanding of Airtel withdraw charges in Uganda, users can optimize their use of mobile money services while ensuring they remain financially savvy.

Read also:Unveiling The Enigmatic World Of John Crimber A Deep Dive

What Are the Airtel Withdraw Charges in Uganda?

The Airtel withdraw charges in Uganda refer to the fees incurred when withdrawing money from an Airtel mobile money account. These charges vary based on the amount being withdrawn and can significantly impact how much users receive after a transaction. It is crucial to be aware of these charges to ensure that users are not taken by surprise when they make a withdrawal.

How Are Airtel Withdraw Charges Structured?

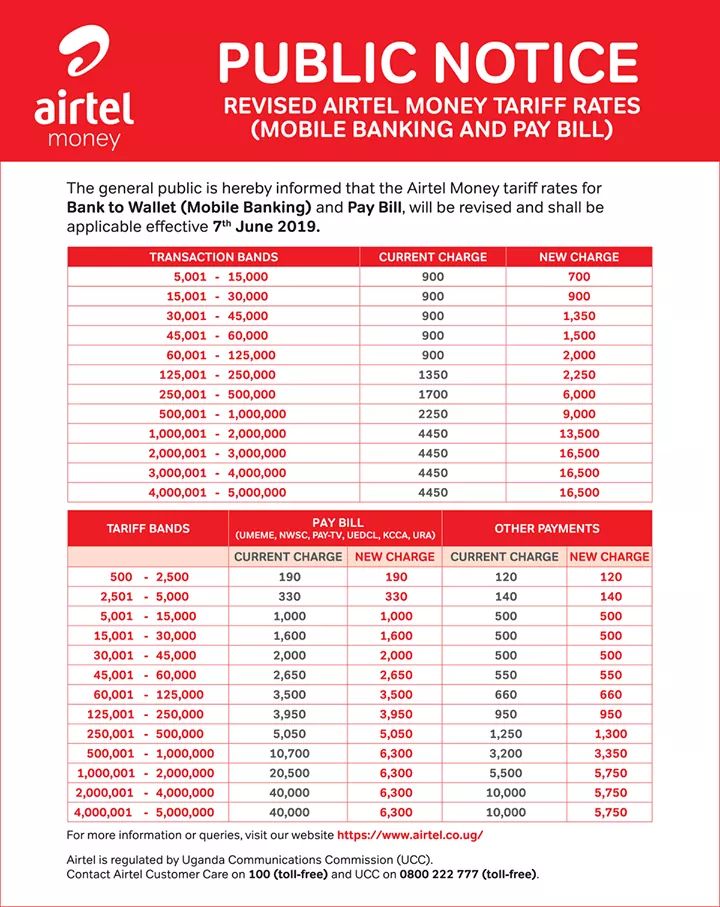

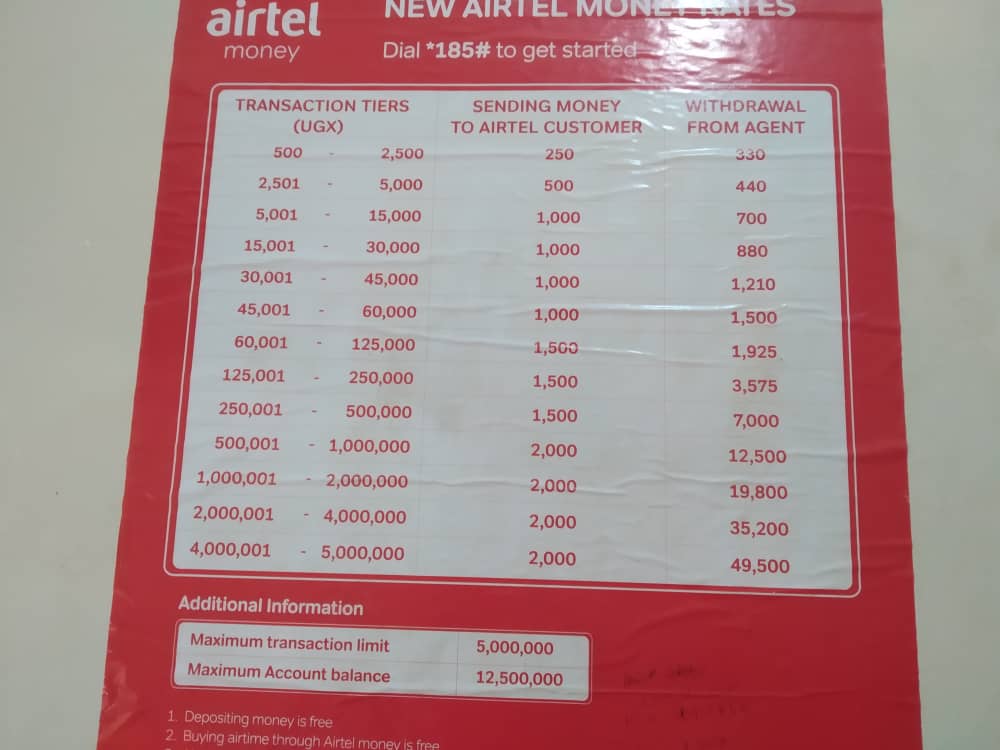

Airtel's withdrawal charges are structured in a tiered manner, meaning that the fee increases as the withdrawal amount rises. Here is a breakdown of the typical withdrawal charges:

- Withdrawals below UGX 1,000 - UGX 0

- UGX 1,000 to UGX 5,000 - UGX 200

- UGX 5,001 to UGX 20,000 - UGX 500

- UGX 20,001 to UGX 100,000 - UGX 1,000

- UGX 100,001 to UGX 200,000 - UGX 2,000

- Above UGX 200,000 - UGX 3,000

Are There Any Additional Fees Associated with Withdrawals?

In addition to the standard withdrawal charges, users should be aware of potential additional fees. These may arise from specific agents or ATM services that may charge their own fees for processing withdrawals. It is advisable to inquire about any potential fees before proceeding with a withdrawal to avoid unexpected costs.

How Can Users Withdraw Money from Airtel Mobile Money?

Withdrawing money from an Airtel mobile money account is a straightforward process. Users can withdraw funds through various methods, including:

- Visiting an Airtel Mobile Money agent

- Using an ATM that supports Airtel mobile money withdrawals

- Transferring funds to a bank account

What Information Is Required for an Airtel Withdrawal?

When withdrawing money, users will need to provide specific information to ensure a smooth transaction. This typically includes:

- The phone number linked to the mobile money account

- The amount to be withdrawn

- The PIN for the mobile money account

Can Users Withdraw Money Without a Registered Agent?

Yes, users can withdraw money without visiting a registered agent by using an ATM equipped to handle Airtel mobile money transactions. This provides greater flexibility for users who may not have immediate access to an Airtel agent or prefer to use ATM services.

Read also:Side Eye Dog The Ultimate Guide To Understanding And Loving This Unique Canine Behavior

How Can Users Minimize Airtel Withdraw Charges in Uganda?

Minimizing Airtel withdraw charges in Uganda can be achieved through several strategies:

- Plan withdrawals to avoid frequent small transactions

- Withdraw larger amounts less frequently to take advantage of lower tiered fees

- Use Airtel mobile money for payments instead of cash withdrawals when possible

Are There Promotions or Offers to Reduce Withdraw Charges?

Occasionally, Airtel may offer promotions that temporarily reduce withdrawal charges or provide incentives for using mobile money services. Keeping an eye on Airtel's announcements and promotions can help users take advantage of these offers to reduce their overall costs.

What Should Users Do If They Experience Issues with Withdrawals?

If users encounter issues when attempting to withdraw funds, they should contact Airtel customer service for assistance. Common issues may include incorrect PIN entries, network problems, or discrepancies in withdrawal amounts. Prompt communication with customer support can help users resolve these issues quickly.

In conclusion, understanding the Airtel withdraw charges in Uganda is essential for effective financial management. By being aware of the fee structure, knowing how to withdraw funds, and employing strategies to minimize charges, users can enjoy a seamless mobile money experience while ensuring they are not caught off guard by unexpected fees. With the right knowledge and preparation, Airtel mobile money can serve as a valuable tool for managing personal finances in Uganda.